Navigating the green transition with INTERSECT

Reaching carbon neutrality by 2050 will require the most disruptive economic transformation in decades. And it remains one of the most complex challenges facing governments and businesses today. To help navigate this transition, Copenhagen Economics and Bain & Company have developed INTERSECT.

What is INTERSECT?

INTERSECT is a tool designed to help you understand the full economic implications of climate action and identify the most effective paths forward. It is a global Computable General Equilibrium (CGE) model that simulates how households, industries, and governments respond to climate policies, price shifts, and technological change.

How can INTERSECT help your business?

Understanding the risks ahead means you can respond to them better. INTERSECT empowers you to explore a wide range of future pathways through scenario analysis that reflect the complex interdependencies of variables.

For example, investing in greater security of supply through diversifying energy sources can reduce vulnerability to trade shocks, but can come with reduced cost-effectiveness in the energy transition. INTERSECT can quantify the trade-offs between these different strategies and identify the most resilient and cost-effective routes to decarbonisation.

Below, you will find examples of scenarios that INTERSECT has helped answer. Click the case studies below to see more.

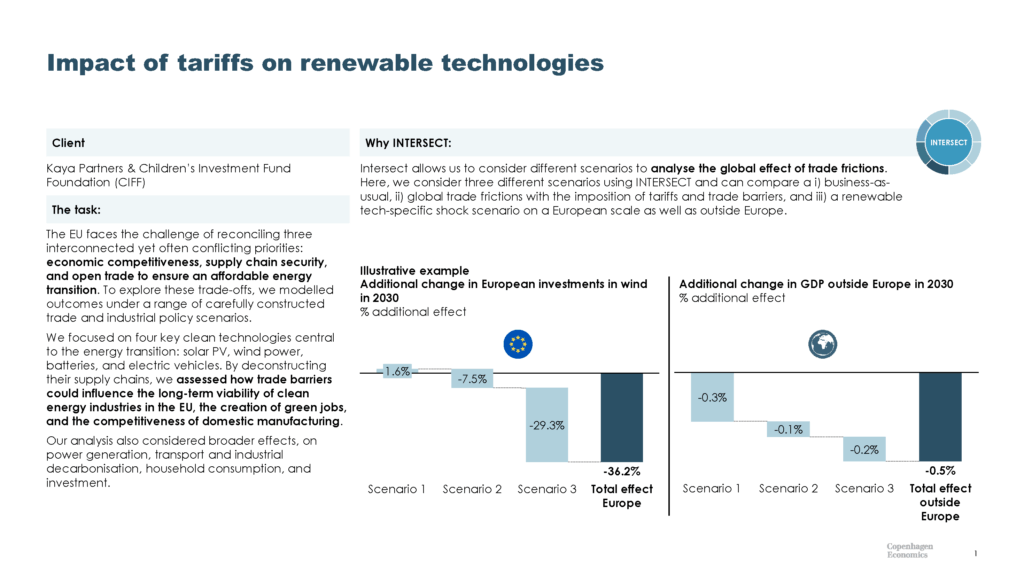

INTERSECT allows us to consider different scenarios to analyse the global effect of trade frictions on value chains for renewable technologies. Here, we draw up and compare three different scenarios using INTERSECT: i) business-as-usual, ii) global trade wars , and iii) decoupling energy supply chains from China using trade policy in the EU/UK.

Click to enlarge

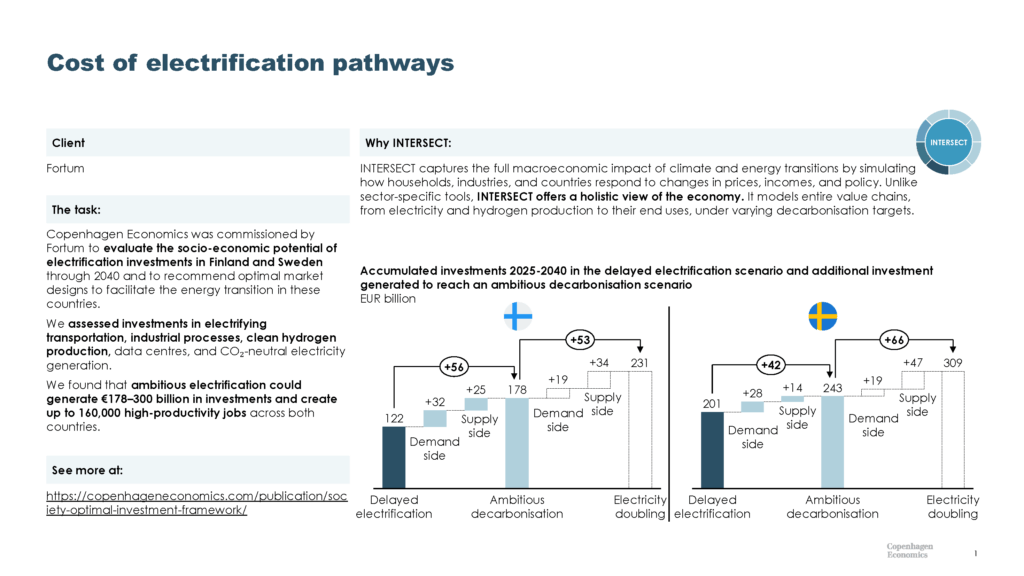

INTERSECT scenario modelling finds that an ambitious decarbonisation scenario could drive €178–231bn of investment in Finland and €243–309bn in Sweden by 2040, creating up to 160,000 high-productivity jobs. To capture these benefits, both countries need long-term market frameworks to secure the energy transition.

Click to enlarge

INTERSECT shows that with the right policies, credible demand, lower trade costs, and reduced investment risks, African green hydrogen production could grow 500% by 2030. This would cut the costs of the European Green Deal, boost energy security, and position Northern Africa as a major hydrogen hub for Europe.

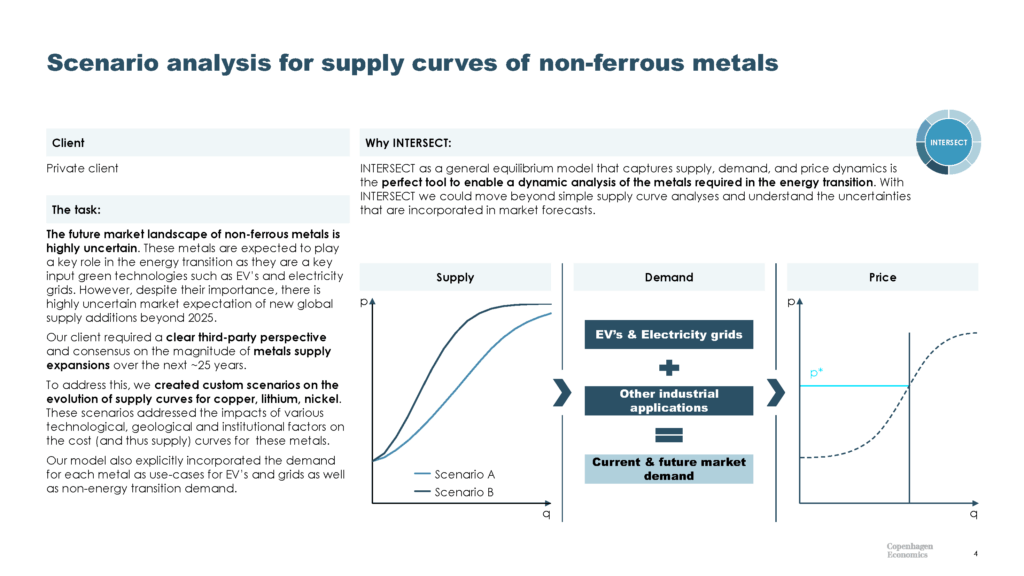

INTERSECT as a general equilibrium model that captures supply, demand, and price effects is a powerful tool that enables a dynamic analysis of the metals required in the energy transition. INTERSECT allowed us to understand the uncertainties that are incorporated in market forecasts.

Click to enlarge

To learn more about our model, see the technical appendix below

An affordable green transition: the what and the how

EU Industrial Policy: Dependencies in global green technology

The role of international credits for an affordable green transition

Navigating the complexities of the green transition: our considered approach to risk analysis

Signe Rølmer Vejgaard

Phone: +45 5373 2310

Mail: sir@copenhageneconomics.com

Listen to how Intersect can help make the green transition more cost-effective (Danish)